Understanding the Probate Timeline: What to Expect and How to Expedite the Process

Need A Florida Lawyer? Fill Out The Form Below

Streamline the Probate Journey: Understanding Timelines and Strategies to Avoid Delays

Understanding the Probate Timeline: What to Expect and How to Expedite the Process

The probate process, which involves legally administering a deceased person’s estate, can take anywhere from a few months to several years, depending on various factors. From filing the initial petition to distributing assets, each step in probate has its own timeline and requirements, often impacted by the estate’s complexity, the executor’s efficiency, and any disputes that may arise. This article outlines a typical probate timeline, factors that can extend or expedite the process, and strategies for managing complexities.

A Typical Probate Timeline

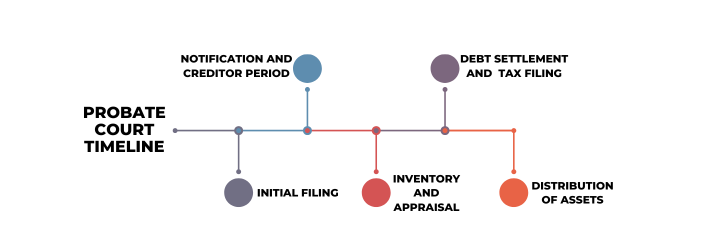

While probate timelines can vary, here is an outline of the typical stages involved:

- Initial Filing: Probate begins when the executor files a petition with the probate court. This initial filing can take a few weeks to a few months, depending on how promptly the executor acts and how busy the local courts are.

- Notification and Creditor Period: After filing, the executor must notify creditors and beneficiaries, often requiring a waiting period (typically 3–6 months) for creditors to submit claims against the estate.

- Inventory and Appraisal: The executor identifies and appraises all estate assets, a process that can take several months, especially if the estate includes complex or hard-to-value assets like real estate, business interests, or collectibles.

- Debt Settlement and Tax Filing: The estate’s debts must be settled, and any necessary tax returns filed, including estate taxes if applicable. This phase can be lengthy if debts or tax issues are complex.

- Distribution of Assets: Once all debts and taxes are addressed, the court approves the distribution of assets to beneficiaries. If there are no disputes, this final phase may be quick; however, disputes over the will or asset distribution can add months or even years to the timeline.

Factors That Affect the Probate Duration

The probate timeline can vary widely based on several factors:

- Size and Complexity of the Estate: Larger estates with diverse assets require more time for inventory, appraisal, and distribution, particularly if they include properties in multiple states or business holdings.

- Presence of a Valid Will: A clear, valid will can expedite the process by providing guidance for asset distribution. Without a will (intestate), the court must follow state laws to determine heirs, which often adds time.

- Executor’s Efficiency: A proactive executor who organizes paperwork and communicates effectively with beneficiaries and creditors can help reduce delays, while an inexperienced or overwhelmed executor may slow the process.

- Beneficiary Cooperation: Disputes among beneficiaries can lead to legal battles that prolong probate, especially if disagreements arise over asset distribution or the will’s validity.

- Creditors and Debts: Estates with significant debts or disputes over creditor claims may take longer, as resolving these matters can delay the estate’s closure.

- State Laws and Court Backlogs: Probate timelines also depend on state laws and court schedules. In some states, simplified processes exist for smaller estates, while others have more involved procedures that lengthen probate.

Ways to Expedite the Probate Process

There are several strategies to help speed up probate, many of which rely on effective planning and proactive actions by the executor and beneficiaries:

- File Early: Initiating probate immediately after the decedent’s passing helps avoid unnecessary delays. Gathering and filing paperwork promptly can reduce lag time at the beginning of probate.

- Prepare Documents in Advance: Having essential documents ready—such as wills, financial statements, property deeds, and tax records—can prevent delays due to missing paperwork.

- Settle Debts Quickly: Identifying and paying off known debts early can help accelerate the estate’s progression to final distribution.

- Notify Parties Promptly: Informing beneficiaries, creditors, and other involved parties early in the process minimizes delays caused by miscommunication or missed deadlines.

- Use Small Estate Affidavits: For estates that meet the state’s criteria for small estate procedures, filing a small estate affidavit can bypass formal probate, significantly reducing time and costs.

- Hire a Probate Attorney: An experienced probate attorney can navigate state laws, handle court procedures, and reduce the risk of procedural errors that might otherwise slow down the process.

Managing Complex Estates: Strategies to Minimize Delays

Estates with complex assets or extensive beneficiary lists often require special attention to avoid extended timelines. Here are strategies for managing these complexities effectively:

- Advance Estate Planning: Setting up a comprehensive estate plan that includes a living trust, joint ownership structures, or clear directives for complex assets like businesses can simplify probate and prevent delays.

- Engage Expert Assistance: Executors handling complex estates should work with professionals—such as probate attorneys, tax advisors, and appraisers—who specialize in estate administration to ensure efficient management of assets and legal requirements.

- Consider Alternative Asset Arrangements: Using tools like living trusts or naming beneficiaries directly on accounts can help bypass probate for certain assets, reducing the estate’s overall complexity.

The probate process can be lengthy and complex, especially for estates with diverse assets, debts, or unresolved family issues. However, with efficient management and planning, many potential delays can be mitigated, making the process smoother for everyone involved.

How Katz & Associates Can Help

At Katz & Associates, we are committed to guiding families through the probate process with expertise and empathy. Our experienced team helps ensure that probate proceeds as efficiently as possible, offering support at every stage. We can assist with everything from initial filings and creditor notifications to asset distribution, helping reduce stress and prevent delays. Contact us today to learn how we can make the probate process easier for you and your family.

Powered and Designed by Boost (boostvse.com)